Poverty isn’t something that you can understand just intellectually—to truly understand someone’s financial struggles, you have to have been where they are. And, frankly, not everyone gets what the grind to survive is like. But getting a glimpse into the everyday hustle can be eye-opening… even if it is but a glimpse.

Redditor 192335 created a viral thread on r/AskReddit and urged internet users to share the things that most people don’t understand about being poor. Have a read, upvote the answers that you agree with, and if you’re feeling up to it, share your own experiences with financial struggles (and how you overcame them) in the comment section.

Financial expert Sam Dogen, the founder of the Financial Samurai blog, spoke to Bored Panda about financial freedom, the importance of consistency in our investments, as well as the things that you need in order to build wealth. You’ll find our interview with him below.

#1Just how little money it would take to drastically help reduce the average person’s stress by well over 50%. I see stories like Post Malone putting 1.5 mil in his mouth, or how much the Kardashians spend on a birthday party & it makes me puke with the sheer pointless extravagance. It’s time we stop treating flaunting wealth & excess like anything other than sociopath behavior in light of the world right now.

Image credits: Booji-Boy

#2As a child in poverty, how little opportunity you have, so many extra curricular activities cost money that just isn’t available, I grew up in a trailer park with a crack addict mum & an alcoholic dad. If I wanted to do something it had to be free & I usually had to forge my mums signature on permission forms. We never had food, I learned to shoplift by 2nd grade. Winters were cold. I still excelled at school, because it was my escape from a shitty home life. I got taken into the foster care system, but I never got adopted, I was in a sh*tty group home, the only way out was to get a job & prove that I could live independently, so I left school at the end of 8th grade & got 2 jobs, cause the wage for a 14y.o.is sh*t, I got signed out of the system, I loved & valued education, so I signed up to do my school certificate & higher school certificate through technical college via distance education. I worked hard & did well, I applied to medical school & smashed the UMAT test. When I got to the interviews, everyone else had all these stories about the community work they did, or learning trips overseas, they’d all had tutoring. It dawned on me that while I was working 60+ hours a week to make a living, these people had been doing things to get a leg up, cause they could, cause they had resources I never had. Being born into poverty is like starting the race 10m behind the block with a broken leg.

Image credits: physiokat

#3Money is practically all you think about. Money does not buy happiness, but not having money certainly buys constant anxiety

Image credits: pajamakitten

Sam, the founder of the Financial Samurai blog, shared with Bored Panda that the key to financial freedom is building passive income streams so that we aren’t “overly dependent” on the income from our day jobs. “The more passive investment income streams you have, the better. Starting with stocks or funds that generate dividends is the easiest for most investors because you can open up a brokerage account and buy just one share. Then you can invest in Real Estate Investment Trusts (REITs) and private REITs as well,” he explained.

According to the expert, the key is consistency and building up your investments slowly, over time. Sam warned us that buying and selling cryptocurrencies won’t generate any income because “it is more of a speculative play.” Despite how lucrative it might all sound, it’s still a risk. You’ll find the expert’s ranking of the best passive investments right over here.

#4I can’t just ‘quit my job’ to ‘find something better.’ Interviews take time that I don’t have. I can’t just skip work to go for interviews

Image credits: Juan_Tutri

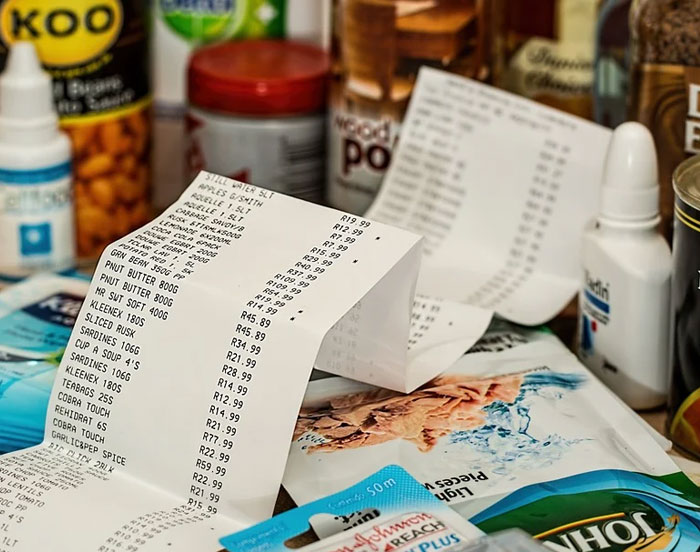

#5People who aren’t poor don’t understand how the expenses stack on top of one another all the time.

Your car breaks down, the cat needs to go to the vet, you find out that your financial aid DOESN’T fully cover your tuition now that you’re at university and not community college… All of this, in a never ending barrage one after another, on top of regular bills.

That’s why the people who go “jUsT sAvE mOnEy” piss me off. When you’re at a certain level of poverty, you can’t because you’re always on the knife’s edge between survival and not being able to pay bills. You need every dime you have and then some.

Image credits: EgyptianDevil78

#6″Poverty is not just bad decisions — poverty is an ENVIRONMENT. It’s bad roads. It’s poor city and county governance. It’s a lack of generational wealth. It’s a lack of access to a grocery store, a doctor, a bank lender, a dentist, plumbers or electricians, a lawyer, a school, a car lot, both financially and geophysically. It’s despair in your landscape through forgotten and abandoned buildings that once housed businesses and families, now left to rot, while you’re too poor to leave. It’s watching others struggle while you yourself are unable to help, because you can’t keep your head above water either.

Image credits: Ribonacci

Sam told Bored Panda that after doing an analysis of Credit Suisse’s annual Global Wealth Report, he came to the conclusion that building wealth requires four things: belief, grit, time, and community. “Roughly 35% of Financial Samurai’s readership are millionaires compared to only 6.5% of America’s population. Therefore, learning as much about your personal finances as possible and interacting with a community are very important,” he said that the information we absorb and the communities (both digital and real) that we surround ourselves with are vital to our long-term success.

“Instead of just reading a book, I’d subscribe to your favorite personal finance site for free that’s continuously writing about new ways to build wealth. Get involved with people who are continuously taking action to build more wealth,” he suggested how we can all further our education in the world of finance.

#7Being poor is exhausting. It’s draining, mentally and physically, and everyone needs a win sometimes. Sometimes that win is finding a way to just afford a meal out or a movie. Yeah, you do have bills to pay, but everyone needs a breath of fresh air sometimes. A struggle needs a break every so often

Image credits: BogeyBogeyBogey

#8Good, healthy food is expensive after bills, and cheap food makes you feel like sh*t

Image credits: TheSexySovereignSeal

#9We can’t be fad minimalists. We don’t let go of most of our stuff because, yes, we might need them in the future, and we’d rather not buy them again

Image credits: thejynerso

Meanwhile, in my previous interview with Sam, he explained that the lack of financial education is the biggest barrier for people to rise out of poverty and become rich. And if you are stuck financially, your priorities always have to be food and then shelter.

“We learn things like chemistry, geology, and English in high school and college, but there are no mandatory courses on personal finance. For example, if more people thoroughly understood their mortgage contracts before signing, the housing crisis between 2008 – 2010 may not have been as deep,” he told Bored Panda earlier.

“In another example, if more people knew they could negotiate a severance instead of quit with nothing, more people would have a more comfortable financial runway to take their time and find a new job or start a new business that is truly meaningful to them. The more people are empowered with financial knowledge, the better financial decisions they can make to ultimately live the lives they desire.”

#10You can have a job and still be poor. You can have a job where you earn $1,000 each month, but if your rent is $600–$700 each month, you spend $100+ on food (assuming you don’t have to take medicine or something similar), your bills, car insurance (if you have a car), and gas for your car, what do you do with what’s left after that? You can’t do anything.

Image credits: glez_fdezdavila_

#11The fear. Fear of something unexpected you haven’t budgeted for. Fear of a knock at the door from a debt collector. Fear of having to choose which of your children can eat more than once today. Fear of having to choose which days you go hungry so your children can eat at all

Image credits: flossgoat2

#12It takes two to three times longer to get anywhere on the bus than in your own car. That means leaving for work earlier and coming home later. In many places, the buses don’t run as often on the weekends. Grocery shopping on the bus means just getting what you can carry, which means going more often, which means more time wasted waiting

Image credits: old-father

According to financial expert Sam, saving money is a powerful tool at your disposal. But the amount you save has to be sufficient. “One of the key mantras I tell my readers is this: If the amount of money you’re saving each month doesn’t hurt, you’re not saving enough! Too many people go through life, paying no attention to their finances. Then they wake up 10, 15, 20 years from now and wonder where all their money went,” he said.

“Always pay yourself first. By paying yourself first after each paycheck, and making it hurt a little to change your spendy ways, only then will you know whether you are saving enough,” Sam urged others to look at saving seriously.

#13Having money isn’t everything. NOT having money is

Image credits: Snoo74401

#14When your parents are lying to you saying they’re full when they’re not so you can have the last bite.

Image credits: swattrip786

#15Just because you’re poor, that doesn’t mean you automatically get welfare. You can make just slightly over the line and still be poor. My mom only made $1,000 a month, but it was still too much to get welfare

Image credits: Kakebaker95

Sam pointed out that large families have various strategies that help them save money, even though they have more mouths to feed. “Use hand-me-down clothing and shoes for all children with occasional aesthetic adjustments between boys and girls if desired. Buy food in bulk. Send kids to a preschool co-op where they require parental involvement usually once a week.”

The expert continued: “Send your kids to public school and forget about the ridiculous cost of private school tuition. Enjoy the free parks and libraries. Have kids share rooms to save on buying a larger house. But the two most important things are having one parent who works to help subsidize healthcare costs and avoiding private schools.”

#16That being physically safe is a luxury, not a given. It can be dangerous to not be conscious for a couple of hours. When you’re homeless and sleeping somewhere, you’re not thinking about tomorrow; you’re thinking, ‘What if I get woken up, and there’s a knife to my face?’

Image credits: xisnotx

#17Having sleep for dinner.

Image credits: Seannj222

#18That poor people can’t take advantage of sales or bulk purchases. They literally spend whatever they earn on basic necessities. Being poor is a vicious cycle, and it takes many sacrifices to get out, if ever

Image credits: kotran1989

#19When you are a kid, the boredom. All of my friends had interests. BMX, hunting, ninja stuff, action figures, and video games. And their parents fostered their interests and provided funds to grow in their hobbies/sports. I had some stuff, too, but never had the sort of continual investment to pursue something like a hobby or interest. Everything was secondhand, bootlegged, pirated, half-working, etc

Image credits: mechtonia

#20If you have a bank account, you probably have to pay a monthly fee because your balance is too low. If you overdraft, they charge you another $35 even though they can see you’ve got nothing in there.

Image credits: old-father

#21The embarrassment and ridicule of letting your teacher and class know that you cannot go to an expensive field trip because your parents do not have the money.#22What it’s like to actually start to starve and be desperate enough to steal food, the longest I ever went without eating was 5 days and it was absolutely miserable

Image credits: I_want_a_HSP ·

#23A lot of things that wealthy people have access too isn’t as accessible or often as good. Its gotta be pretty friggin annoying for people who can barely afford food to be told that they should see a therapist. Like yeah, mental health is important but so is eating, and mental health is also going to take a hit when the money you used to talk to a therapist for an hour is going to eat into your food budget or bill money

Image credits: radpandaparty

#24When we save up money, something happens that forces us to use that money we had saved, which starts a hard-to-break cycle

Image credits: Chicago1202

#25That you never sleep well at night, NEVER! Your mind is constantly in overdrive wondering which bill(s) will or not get paid this month. That the smallest unexpected expense can completely put you over the edge.#26Growing up poor leaves scars that never heal.

Image credits: drlavkian

#27When you’re really poor, everything you see is something you can’t have

Image credits: RWD235

#28Most of the time it’s out of their control, there’s usually a backstory. Also it’s harder to pull your self out of poverty than most expect.

Image credits: Weird-Difference-917

#29Ninety percent of the time, you cannot fail or make a bad/wrong decision. If you do, it will take years and years to recover from that.

Image credits: aspluiz

#30It takes up all of your time. I remember not being able to stock up on necessities. So I would have to run to the store a lot more frequently. I couldn’t afford a car so I would either have to bus or walk. All of these little things eat up so much time

Image credits: SparkyValentine

#31The lengths you’ll go to so you can avoid falling back into poverty after you got out of it.#32Constantly having to move because your job demands it, or because rent got too high. One to two years is how long I’d stay in one house as a child. I never bothered with friends, because I knew I wasn’t going be around them for more than a year or so.

Image credits: ClericGaming1

#33What is the true meaning of the term “priority”#34Everything you buy has interest attached to it, because you’re NOT using that money to pay off debts that you definitely have.

Image credits: Kanedi4s

Read more: boredpanda.com