You might have been reading a lot about video game retailer GameStop in the news and on social media recently. And now, even the White House is monitoring the situation. What’s going on right now is the financial-world equivalent of the battle between David and Goliath… or rather between small investors and Wall Street. And it’s a story for the economics books, ladies and gentlemen, no matter who the winner turns out to be in the end.

In short, small investors, who are mostly based in the r/wallstreetbets subreddit, are massively investing into GameStop because they believe in it as a company, causing its price to surge upwards. Meanwhile, Wall Street was betting on GameStop failing as a company and its stock prices to stay low. Now, Wall Street hedgefunds that were shorting stocks are hemorrhaging money. Some small investors have already ended up millionaires because of this. For instance, Bloomberg reports that “one trader turned $53,566 into more than $11 million.”

Bored Panda has collected some of the best memes about and reactions to GameStop stonks battle between Reddit and Wall Street, so scroll on down, give your fave pics a big ol’ upvote, and let us know what you think about the entire situation in the comment section below. And be sure to read our in-depth interview with a banking expert and independent investor about what’s going on with GameStop.

But before we begin, a big, chunky note of warning for all of you: never, ever trust any random bits of advice about investment opportunities that you read online without turning on your critical thinking and evaluating your current financial situation. Sure, the stock price might be rising now, but you never know when it’ll fall (and any expert who tells you that they know how the market will change for sure is selling you snake oil, whether they’re from Wall Street or from Reddit). If you do decide to invest, do so at your own risk, and don’t gamble away your future just because you’re hyped to become a millionaire—just like everyone else is. And not everyone can be a winner when it comes to stocks.

A one-word tweet from Elon Musk caused a further massive GameStop stock price surge

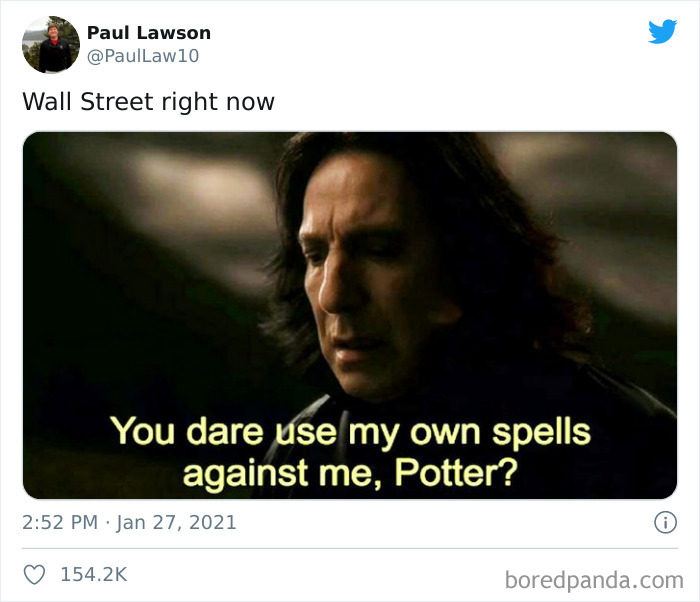

#1

#1

Image credits: PaulLaw10

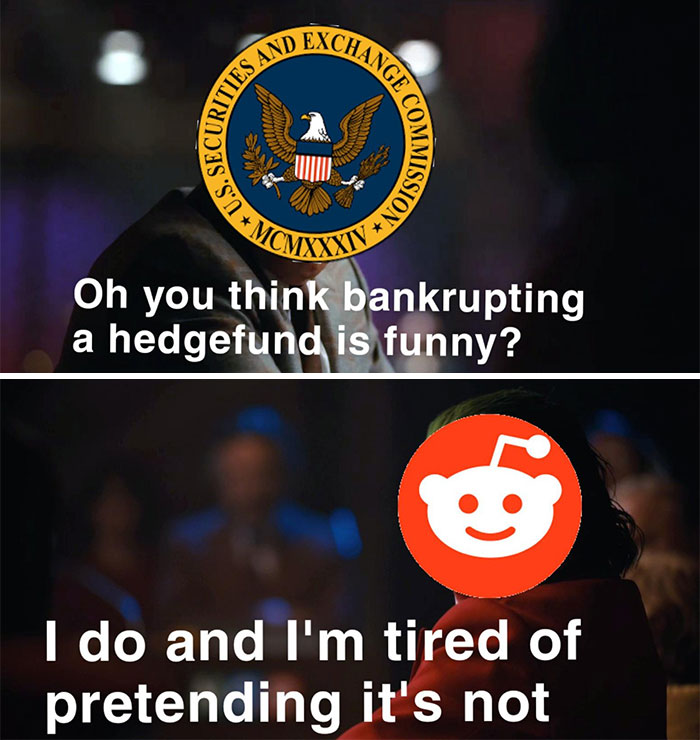

#2

Image credits: existentialcoms

#3

Image credits: GaydolfHipster

The White House is monitoring the GameStop situation and the “market volatility in the options and equities markets.” You know that what’s going on is serious when you see the top political players in the US reacting.

GameStop share prices had been at a low of just over $3 in April 2020. The price is $347 at the time of writing, but it’s always in flux, so go and get an update on that number whenever you’re reading this.

Redditors are already celebrating after a major Wall Street hedgefund, Melvin Capital Management, pulled out after losing 30% of the $12.5 billion that it manages this year. The fund was banking on GameStop prices staying low to make profit. However, as the prices kept rising, the fund lost money as it relied on its risky short-selling strategy.

#4

Image credits: MikeDrucker

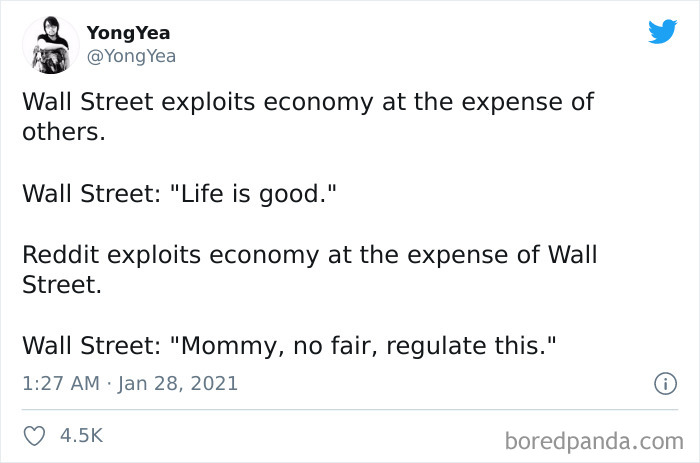

#5

Image credits: YongYea

#6

Image credits: Jordan_Deeb

A banking expert and independent investor spoke to Bored Panda about the current situation in the stock market and all of the investment advice floating around on the net and on the news under the strict condition of keeping his identity anonymous. “First of all, nobody knows the future, and if any financial guru (whether anonymous or sitting in an expensive suit in front of you) tells you about some ‘guaranteed opportunity to double your money,’ consider it a red flag,” he pointed out that anyone making investments should be careful and think for themselves.

“Secondly, one of my personal golden rules for investment is the following: if everyone, including your grandmother, is talking about some particular stock or cryptocurrency—it’s already too late. Should people invest? Absolutely, but not necessarily in GameStop—there are dozens of opportunities like that every year, so don’t feel bad if you think you missed out on this one,” the expert stressed that timing is everything but that other opportunities will always present themselves.

According to the independent investor, wild fluctuations in price are something that we sometimes see in the “traditional” stock market from time to time; it’s not just an everyday feature of the cryptocurrency market. And even though we’re all focused on GameStop right now, we shouldn’t forget about companies like Tesla.

“Consider Tesla—had you invested any money in it a year ago, you would have increased your stack at least sixfold! Sharks in Wall Street hedge funds, smelling blood, tried shorting (betting against) GameStop’s stock, but underestimated the sheer volume of small individual investors who have easy access to markets thanks to apps like Robinhood, eToro, etc. and can share their intentions via social networks. This example might indicate that the age of individual investor (as opposed to institutional) is not over just yet.”

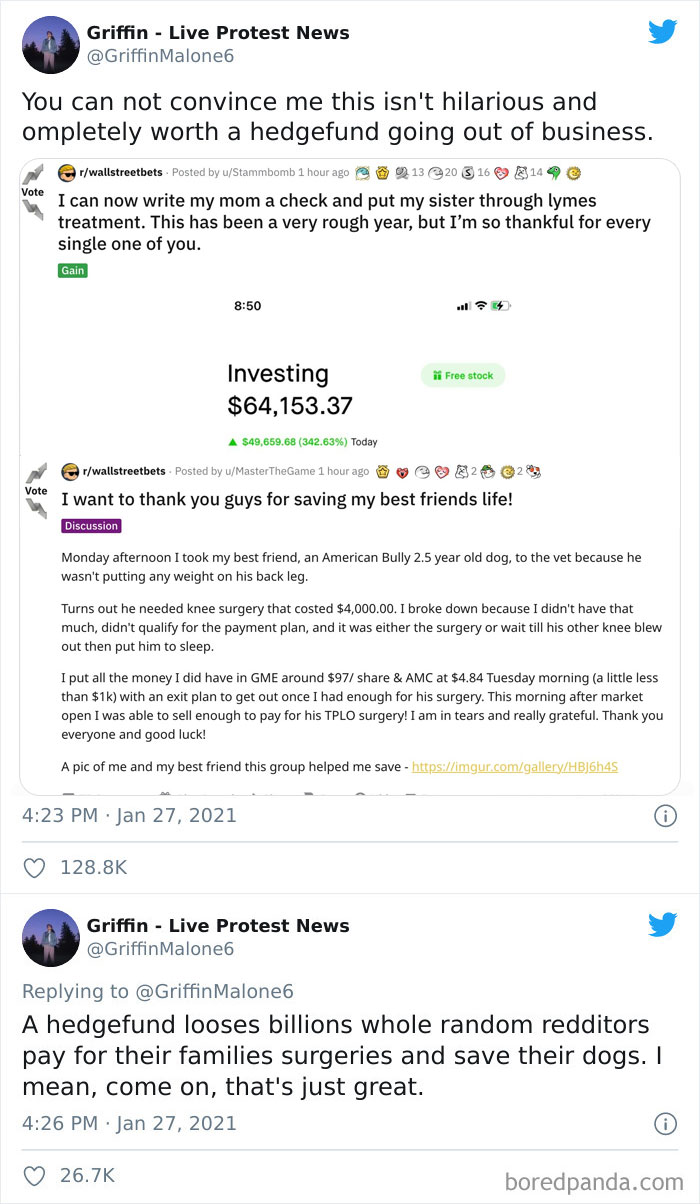

#7 #8

#8 #9

#9

Image credits: OldPappyThomas

As for the future of GameStop? It all depends on how well they ride “this tsunami of electronic entertainment.” The banking expert and investor said: “An influx of funds might allow GameStop to reinvent their business model and concentrate almost purely on digital sales and remote deliveries. They might decide to leave only a few brick-and-mortar places for that authentic old-school experience, for example. Did you know that global video game revenue is already larger than Hollywood’s?”

It’s not just GameStop that’s getting some love from investors, though. Movie theater chain AMC is also seeing its stocks skyrocket among other companies.

Meanwhile, the r/wallstreetbets subreddit went private for around an hour on Wednesday. What’s more, Discord banned the subreddit’s server for “hateful content” after repeated warnings. The subreddit accused Discord of “destroying their community” instead of trying to fix any issues at hand.

The subreddit modmail is down temporarily at the time of writing which, to us, suggests that the mods are getting absolutely bombarded with messages, spam, and requests for investment advice. Just imagine the flood.

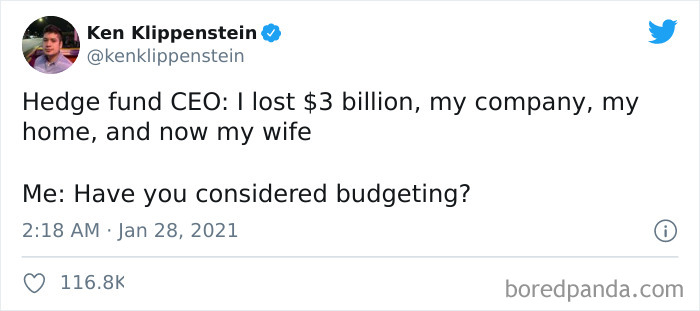

#10

Image credits: kenklippenstein

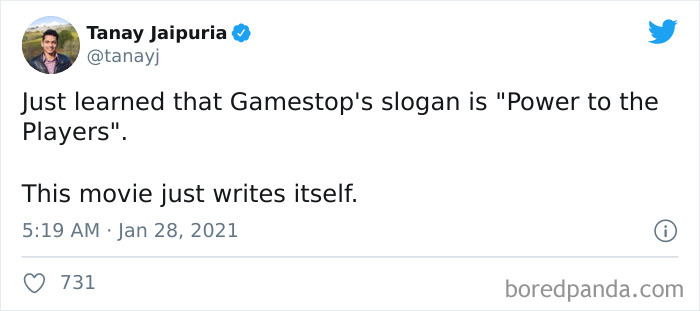

#11

Image credits: tanayj

#12

Image credits: AltHistoryHub

Here’s what Investopedia says about short-selling (i.e. what some hedgefunds were doing in the case of GameStop and continue to do in many other cases): “Short-selling occurs when an investor borrows a security and sells it on the open market, planning to buy it back later for less money. Short-sellers bet on, and profit from, a drop in a security’s price. This can be contrasted with long investors who want the price to go up. Short selling has a high risk/reward ratio: It can offer big profits, but losses can mount quickly and infinitely due to margin calls.”

Part of the reason why redditors are investing in GameStop and other companies is to ‘punish’ Wall Street hedgefunds for their practice of shorting stocks. Some small-time investors believe that what these funds are doing is immoral.

It’s not just Melvin Capital Management that has had to run with its tail between its legs. For instance, a week ago, Citron Research bet that the 37-year-old GameStop company would fail; this motivated a lot of redditors to heavily invest in the company, forcing Citron to back off from short-selling stocks.

#13

Image credits: herosnvrdie69

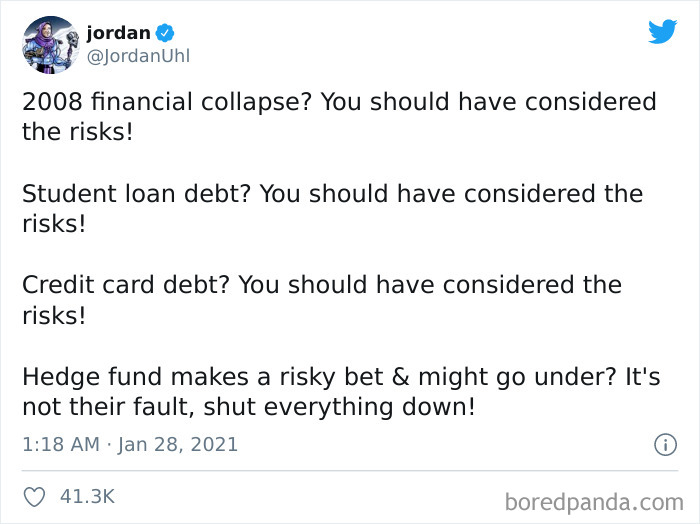

#14

Image credits: JordanUhl

#15

Image credits: bocxtop

#16

Image credits: MightyKeef

#17

Image credits: TheEpicDept

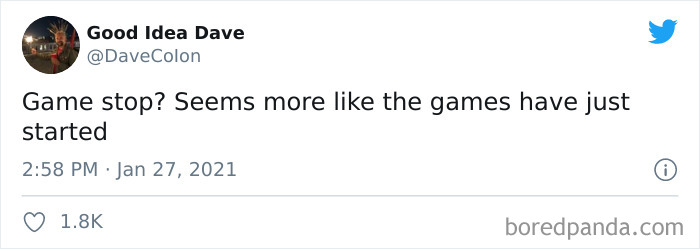

#18

Image credits: DaveCoIon

#19

Image credits: jerryiannelli

#20

Image credits: DarihanaNova

#21

Image credits: hshaban

#22

Image credits: rafcastv

#23

Image credits: Hernan_Dioz

#24

Image credits: VeryBadLlama

#25

Image credits: LilySimpson1312

#26

Image credits: AmericasComic

#27

Image credits: existentialcoms

#28

Image credits: Delicious_Tacos

#29

Image credits: Wildcard_GG

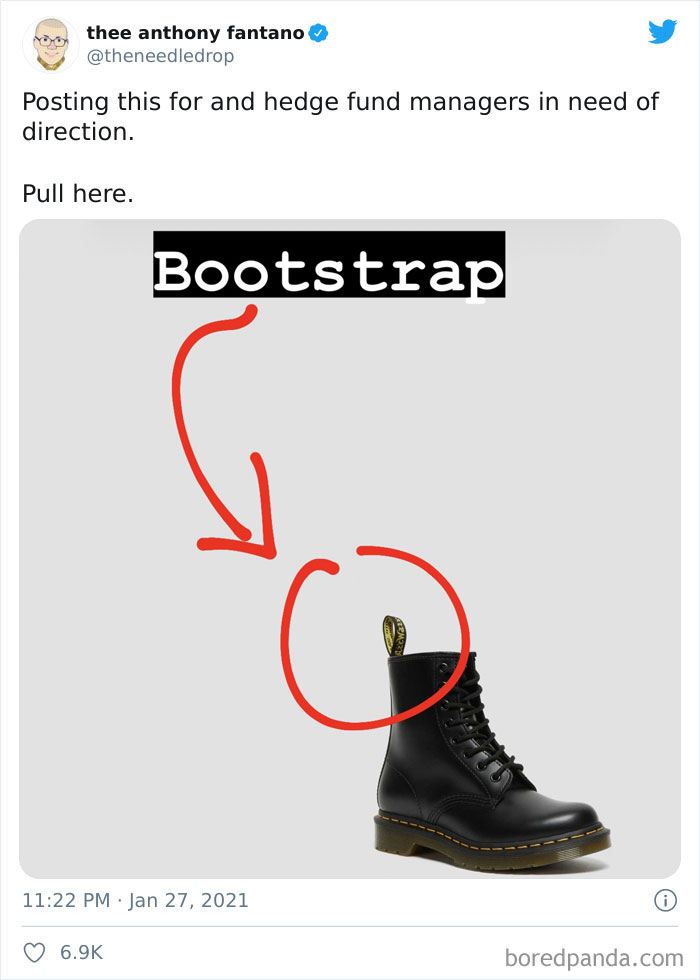

#30

Image credits: theneedledrop

#31

Image credits: eeberquist

#32

Image credits: Nash076

#33

Image credits: kimpossiblefact

#34

Image credits: RealOldPaul

#35

Image credits: rachsyme

Read more: boredpanda.com